If you’ve recently walked into your favorite Macy’s and noticed “Store Closing” signs, you’re not alone. The iconic department store—once the beating heart of American shopping—has been undergoing a massive transformation. In 2025 and 2026, Macy’s plans to close dozens of locations across the country as part of a sweeping effort to reshape its business model. From sprawling mall anchors to neighborhood boutiques, the face of Macy’s is changing, and millions of loyal shoppers are feeling the impact.

This shift isn’t just about downsizing—it’s about survival in a retail landscape that looks nothing like it did a decade ago. As online shopping skyrockets and consumer habits evolve, Macy’s is trying to reinvent itself to stay relevant. But what exactly is happening? Which stores are closing, when will they shut their doors, and what does this mean for the average shopper? Let’s dive into the full picture of Macy’s store closures in 2025–2026, explore the reasons behind them, and see what’s next for one of America’s oldest retail giants.

Why Macy’s is Closing Stores in 2025–2026

When Macy’s first announced a wave of closures years ago, many hoped it would be a one-time adjustment. However, by 2025, it’s clear the company is undergoing a deeper structural shift. Several key factors are driving this decision.

First, economic pressures continue to weigh heavily on department stores. High inflation, rising rents, and changing labor costs have made large-format stores increasingly difficult to sustain. Many of Macy’s traditional mall-based stores simply aren’t generating the same revenue they once did.

Second, there’s been a massive shift in consumer behavior. Shoppers today crave convenience, speed, and personalization—things that are easier to deliver online than in sprawling stores. Younger generations, in particular, prefer curated experiences, smaller spaces, and a mix of online and offline options.

Third, the rise of e-commerce has permanently altered the retail landscape. Amazon, Target, and other hybrid retailers have trained consumers to expect fast shipping, competitive pricing, and hassle-free returns—all of which put pressure on traditional department stores to adapt.

Macy’s closures, therefore, are part of a broader strategy to focus resources on what’s working—namely, e-commerce, smaller stores, and luxury spin-offs like Bloomingdale’s and Bluemercury. It’s not necessarily the end of Macy’s—it’s a rebirth, albeit a painful one.

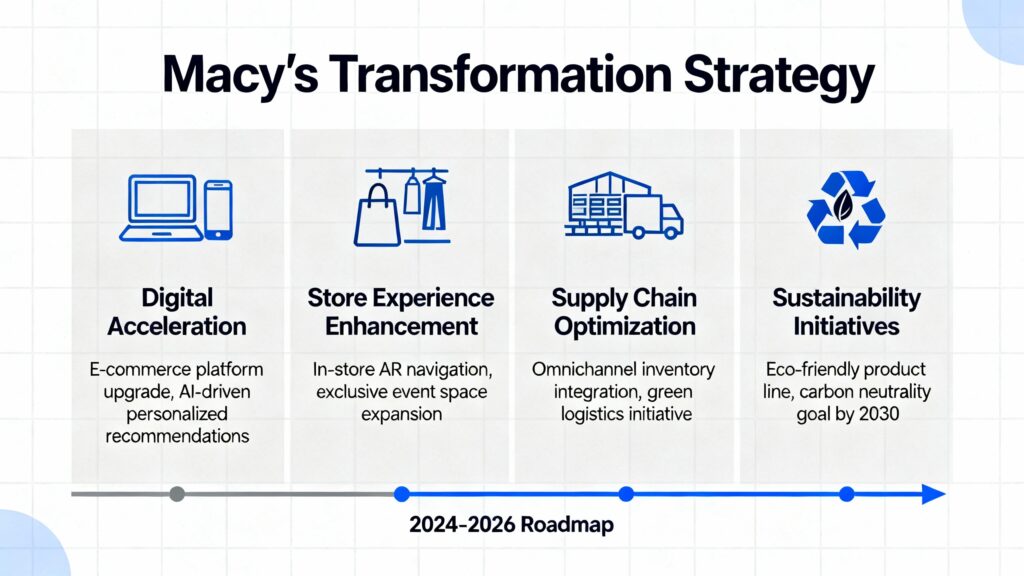

The Big Picture: Macy’s Transformation Strategy

Macy’s transformation isn’t random—it’s the continuation of the company’s “Polaris” strategy, first introduced in 2020. The goal? To make Macy’s more agile, efficient, and digitally focused. Under this plan, Macy’s has been gradually closing underperforming locations while investing in online platforms and new store formats.

The company’s CEO has emphasized that this shift is essential to “meet the customer where they are.” That means more investment in technology, personalized shopping tools, and smaller stores located closer to suburban and urban hubs instead of traditional malls.

The company’s digital revenue has already shown strong growth, accounting for nearly one-third of total sales by 2025. Macy’s wants to double down on this by enhancing its app, offering same-day delivery, and integrating virtual styling tools. In other words, the Macy’s of 2030 may look more like a hybrid of Amazon and Nordstrom Local—digital at its core, but with physical touchpoints for convenience and service.

Timeline of Macy’s Store Closures (2025–2026)

Macy’s closures are happening in phases, stretching from early 2025 into 2026. The company began notifying employees and customers in late 2024, with the first round of closures starting in January 2025.

According to internal reports and retail analysts, the closures are strategically staggered to minimize disruption and manage liquidation sales effectively. The 2025 wave targets roughly 50–60 stores, mostly older locations in struggling malls or overlapping markets. By 2026, another 30–40 stores are expected to close as Macy’s completes its transformation phase.

The regions most affected include the Midwest, Northeast, and parts of California, where mall traffic has declined the most. Cities like Cleveland, Pittsburgh, and Sacramento have already seen closures, while suburban markets in Texas and Florida are next in line.

Each store typically closes within 8–12 weeks after the announcement, following clearance events offering discounts up to 70%.

Full List of Macy’s Store Closures in 2025

As of early 2025, Macy’s has publicly confirmed a list of store closures across several states. While some are permanent shutdowns, others are part of strategic relocations or conversions into smaller “Market by Macy’s” stores. Below is a breakdown of known and expected closures based on internal reports and local news releases:

| State | City/Location | Closure Status |

|---|---|---|

| California | Sacramento (Arden Fair Mall) | Closing Spring 2025 |

| California | Riverside (Galleria at Tyler) | Closing Summer 2025 |

| Illinois | Peoria (Northwoods Mall) | Closing Early 2025 |

| New York | Rochester (Marketplace Mall) | Closing March 2025 |

| Ohio | Cleveland (SouthPark Center) | Closing February 2025 |

| Pennsylvania | Pittsburgh (Ross Park Mall) | Closing April 2025 |

| Florida | Tallahassee (Governor’s Square) | Closing June 2025 |

| Texas | Plano (Collin Creek) | Closing May 2025 |

| Michigan | Grand Rapids (Woodland Mall) | Closing Q2 2025 |

| Oregon | Eugene (Valley River Center) | Closing Summer 2025 |

Beyond this confirmed list, additional locations are under review. Macy’s plans to provide rolling updates through press releases and local media. Many of these closures coincide with the end of mall leases or the expiration of redevelopment agreements—signaling Macy’s intent to reduce overhead and pivot to more profitable models.

What’s particularly notable about the 2025 closures is their concentration in secondary markets—mid-sized cities and suburban malls that have seen declining foot traffic for years. This pattern mirrors Macy’s earlier waves in 2020–2023, which targeted similar underperforming markets.

Expected Macy’s Store Closures in 2026

Looking ahead to 2026, Macy’s is expected to continue trimming its footprint by another 30 to 40 stores. While exact locations haven’t all been disclosed, analysts predict that most will be in low-performing mall regions or markets already served by nearby Macy’s or Bloomingdale’s locations.

Potential closure candidates include older stores in the Midwest and Northeast, where consumer traffic and sales per square foot lag behind the national average. Additionally, Macy’s is reviewing lease renewals across its portfolio—meaning many stores could close simply because the company doesn’t see long-term value in keeping large mall anchors open.

Retail analysts suggest that Macy’s 2026 closures will focus more on real estate optimization than cost-cutting. The brand is expected to sell or repurpose prime properties to developers, potentially turning old department stores into mixed-use spaces or even mini-distribution hubs to support e-commerce fulfillment.

Macy’s executives insist that the closures are part of a “strategic reset,” not a retreat. The brand intends to balance its physical presence with online growth, optimizing its footprint to match where consumers actually shop and live today.

Impact on Macy’s Employees

One of the hardest-hit groups in this transformation is Macy’s workforce. With each store closure, hundreds of employees face uncertain futures. In 2025 alone, the closures are expected to affect over 5,000 employees nationwide, from sales associates and managers to backroom staff.

However, Macy’s has outlined several transition support measures to help displaced workers. These include transfer opportunities to nearby stores, severance packages, and career assistance programs that connect employees with new job openings in the retail sector.

For employees in regions where Macy’s plans to open new “Market by Macy’s” locations, some may find opportunities to transition into these smaller, more modern store formats. The company has emphasized its commitment to “supporting employees through every stage of change,” though many workers still express frustration over short notice periods and limited options.

Union groups and local labor advocates have been calling for Macy’s to provide extended benefits and retraining initiatives, especially for long-time employees who have served the company for decades. As the retail industry evolves, the fate of Macy’s workers symbolizes a broader issue—how traditional retail employment is shrinking while digital commerce grows.

What It Means for Shoppers

If your local Macy’s is closing, you’re probably wondering what it means for you as a shopper. The short answer: there are both losses and new opportunities.

On one hand, the closures mean fewer in-person shopping options. Loyal customers who’ve relied on Macy’s for special occasions—like weddings, prom, or holidays—may need to travel farther or shop online instead. For many, the emotional connection to their local store, especially long-standing ones, adds an element of nostalgia to these closures.

On the other hand, Macy’s is promising a more seamless digital experience. The company has ramped up its website, improved its mobile app, and integrated better delivery options, including curbside pickup and same-day shipping in select areas.

There’s also the benefit of major clearance sales. Before closing, stores typically hold liquidation events offering discounts up to 80% on clothing, jewelry, home goods, and cosmetics. Savvy shoppers can snag incredible deals—though they should act fast, as popular items tend to sell out quickly.

Macy’s loyalty programs, gift cards, and credit accounts remain valid both online and at other locations, so customers won’t lose their points or rewards. The company is also urging shoppers to sign up for email alerts to stay informed about local store events and online-exclusive offers.

Macy’s Smaller Store Concept: The Future of Retail

Macy’s shrinking footprint doesn’t mean Macy’s disappearing — it means Macy’s evolving. Over the past few years the company has been experimenting with smaller formats designed to cost less to operate while still delivering the brand’s assortment and service. Think of these smaller shops as a hybrid between a department store and a specialty boutique: curated assortments, faster merchandising turnover, tighter layouts, and tech-forward service.

Why does this work? Big department stores carry lots of inventory across a huge footprint — which was great when customers wanted to browse for hours. Today, shoppers often want to find a specific item quickly (a dress, a set of sheets, a pair of boots), try it on, and either take it home or have it delivered the same day. Smaller stores can be placed in higher-traffic urban locations, lifestyle centers, and transit hubs where a 100k+ sq ft anchor store would be impossible or uneconomical.

Typical features of Macy’s smaller-format stores:

- A curated selection of best-selling brands and categories tailored to local demand.

- Click-and-collect hubs for faster pickups and returns.

- Personal shopping/appointments with stylists in compact consultation rooms.

- Pop-up space for premium brands or local designers to test products.

- Integrated digital screens and mobile checkout to reduce friction.

Macy’s experiments are varied: some locations are branded as “Market by Macy’s” (a smaller, grocery-adjacent concept), others are simply compact Macy’s with revised merchandising. The advantage is agility — Macy’s can open more locations with lower lease costs, be closer to customers, and use those spots for both sales and marketing. The trade-off is that shoppers lose the one-stop-shop breadth of a full-line department store; but for convenience-oriented consumers, the new formats can be more relevant.

The Shift to Online Shopping

Let’s be blunt: Macy’s is now as much an e-commerce company as it is a store operator. The closures give the company an opportunity to redeploy capital into digital infrastructure, logistics, and customer-experience engineering.

Key elements of the digital shift:

- Fulfillment & last-mile: Macy’s has been converting parts of closed stores into local fulfillment hubs, enabling faster deliveries and reducing shipping costs. This helps support same-day delivery and curbside options that customers increasingly expect.

- Personalization: Investing in algorithms and data science to personalize product recommendations, email marketing, and on-site search — turning browsing into conversion.

- Omnichannel integration: Improving the seamlessness between online orders and in-store services (returns, pickups, in-person styling), which is critical if fewer stores remain.

- Mobile-first experiences: Optimizing apps for easy checkout, push deals, and loyalty integration. Mobile wallets and contactless payments also reduce friction.

- Virtual try-ons and AR: Where possible, Macy’s has piloted augmented-reality and virtual-fitting-room tech to reduce fit-related returns and increase consumer confidence.

For shoppers, this means more convenience but also a heavier reliance on shipping timeframes and digital customer service. If you loved in-person fixtures, sample rooms, or discovering hidden gems while wandering a store, the online pivot will feel different. But for those who prioritize speed and selection, Macy’s online improvements may deliver more value than a distant physical store ever could.

How Macy’s Closures Affect Malls Across America

Macy’s has long been an anchor tenant — the department store that pulls shoppers to a mall. Losing an anchor is rarely just an isolated retail story; it ripples through an entire shopping center’s ecosystem.

What happens after an anchor closes:

- Reduced foot traffic: Smaller retailers in the mall often rely on the anchor’s customer flow. When Macy’s shutters, adjacent specialty stores may see steep drops in walk-in customer volume.

- Lease renegotiations & vacancy cycles: Mall owners scramble to re-lease the large space. Some convert anchors into multiple smaller storefronts; others repurpose them into gyms, entertainment venues, office space, or medical clinics.

- Real estate redevelopment: Prime real estate — especially in urban areas — may get converted into mixed-use projects (retail on the ground floor, residential or office above). This is a trend that benefits local tax bases but changes the retail landscape.

- Short-term sales spikes: Local retailers sometimes see a temporary bump during Macy’s liquidation period as shoppers hunt deals, but that usually fades once inventory is cleared and the sign goes up.

For consumers, mall trips may become more fragmented. Instead of a single large department store visit, people may choose a combination of specialty shops, off-price retailers, and online ordering. The mall’s future often depends on the owner’s creativity and the local market’s health.

Competitors in the Retail Game: Who’s Thriving?

Macy’s isn’t operating in a vacuum. The retail winners and losers of 2025–2026 reveal where consumer preferences landed. Here’s a quick look at how Macy’s stacks up against common competitors:

- Nordstrom / Nordstrom Rack: Nordstrom has leaned into customer service and off-price models. Its local service focus and loyalty programs keep it competitive in higher-end apparel.

- Kohl’s: Kohl’s has been nimble with third-party partnerships and off-price strategies (plus aggressive loyalty offers), making it a close competitor in value and convenience.

- Target: Target’s general merchandise + grocery + style-focused brands (and strong omnichannel execution) have made it a direct competitor for everyday apparel and home goods.

- Amazon: The online giant competes on convenience and price; Macy’s counters with private labels, branded partnerships, and store-based services that Amazon can’t replicate physically.

- Fast-fashion & specialty brands: Retailers like H&M, Zara, and specialty stores have carved out specific customer niches — often faster to market for trends than Macy’s traditional assortment.

Macy’s response has been to sharpen its private labels, expand brand partnerships, and emphasize services (like personal stylists and in-store events) that are harder to replicate online. Whether that’s enough is an open question — but Macy’s clearly believes a smaller, digitally-native footprint plus brand differentiation is a survivable strategy.

Customer Reactions and Social Media Buzz

Store closures bring out loud emotions. Social media has been full of nostalgia posts — former employees sharing memories, customers posting photos of last purchases, and local communities lamenting lost landmarks. At the same time, deal-hungry shoppers share liquidation finds and tips on scoring final markdowns.

Common themes across customer reactions:

- Nostalgia and grief: For many, Macy’s was where first prom dresses and wedding registries happened. Closures feel like the end of a cultural touchstone.

- Practical advice: Users trade tips on which stores have the best final sales, how to get the most from loyalty points, and whether to wait for additional markdowns.

- Calls for transparency: Employees and customers frequently ask for clearer timelines regarding returns, gift card usage, and loyalty programs.

- Brand defenders vs. critics: Some praise Macy’s for being forward-thinking; others blame management for not adapting sooner.

For local businesses and communities, social media also becomes a channel to seek new uses for vacant spaces — petitions, redevelopment ideas, and grassroots campaigns sometimes emerge to save or repurpose store locations.

What Shoppers Should Do Before Their Local Macy’s Closes

If your Macy’s is on the closure list, here’s a practical checklist to make the most of the final weeks and protect your interests:

- Use gift cards and store credit early. Don’t risk losing access — redeem them while the store still has staff to assist.

- Check loyalty balances and rewards. Ensure points are applied to eligible purchase or transferred to Macy’s accounts online.

- Bring receipts for returns. Return policies can shrink during liquidation; confirm the store’s return window and whether online returns are accepted.

- Shop liquidation sales for deals — but inspect items carefully. Returns during final clearance windows can be more restrictive, and some items sold “as is.”

- Ask about transfer or employment opportunities. If you work there, check internal postings for nearby stores or fulfillment jobs.

- Sign up for online accounts. If you don’t have an account at macys.com, create one and link your rewards so you don’t lose value.

- Plan for services like bridal registries and alterations. Confirm how those services will be handled moving forward — some may be transferred to nearby stores or shifted online.

- Consider alternative retailers. If you relied on Macy’s for specific categories (e.g., cookware, bedding, suits), identify alternatives (department stores, specialty shops, online brands).

These steps lower the chances of surprises and help you capture remaining value — whether that’s deep discounts or continued customer benefits through Macy’s online ecosystem.

The Future of Macy’s: Can It Bounce Back?

Can Macy’s survive and thrive? The short answer: yes — but only if it executes multiple complex moves simultaneously.

Success factors:

- Executing omnichannel flawlessly: Store closures only help if the online and remaining-store experience is exceptional. That includes reliable fulfillment, easy returns, and personalized service.

- Smart real estate decisions: Selling or repurposing closed stores into revenue-generating assets (fulfillment centers, leased sections, mixed-use properties) can improve the balance sheet.

- Brand differentiation: Macy’s must avoid being a commodity seller. Exclusive brands, curated lines, and service-driven experiences can create defensible value.

- Employee transition and culture: Retaining knowledgeable staff and training for new roles (e.g., fulfillment, digital customer service) improves customer experience.

- Financial discipline: Reducing legacy costs while investing in high-return areas (technology, logistics) must be balanced carefully.

Retail watchers expect Macy’s to persist — department stores have shown adaptability before — but the company will look different: fewer giant anchors, more compact locations, and a digital-first presence. For shareholders and customers, the speed and quality of that transition will determine whether Macy’s remains an American retail mainstay or slips into a smaller, more niche role.

Practical Alternatives for Shoppers (Where to Go Instead)

If your local Macy’s closes, here are practical alternatives depending on what you bought there:

- Apparel & shoes: Nordstrom/Nordstrom Rack, Kohl’s, JCPenney, Target, specialty boutiques, online marketplaces (Zappos, ASOS).

- Home goods & bedding: Bed Bath & Beyond (where present), Target, Wayfair, local home stores, IKEA for basics.

- Beauty & cosmetics: Sephora, Ulta, Bluemercury (part of Macy’s family in some markets), department counters at other stores.

- Jewelry & watches: Local jewelers, Kay, Zales, and online specialists.

- Gifts & small household items: Target, Amazon, and independent gift shops.

Also consider direct-to-consumer (DTC) brands for items like mattresses, bedding, and apparel — many of these offer free trials and direct shipping.

Tips for Scoring the Best Deals During Liquidation

If you love a bargain, liquidation periods can be goldmines — if you play smart:

- Visit early for selection, later for lower prices. Early liquidation means more items but higher prices; later typically means deeper markdowns but fewer sizes.

- Inspect items carefully. Some clearance merchandise may be final sale or slightly damaged.

- Ask about coupons and store card discounts. Sometimes Macy’s will allow certain cardholder savings even during closings.

- Track inventory online. Some systems will reflect stock remaining at closing stores even during liquidations.

- Bring a measuring tape for home goods. Ensure lamps, rugs, and bedding dimensions match home needs.

Legal, Gift Card & Return Considerations

A couple of legal and procedural points to keep in mind:

- Gift cards and store credit: Typically valid until expiry dates listed, and many retailers honor them at sister stores or online. Confirm with Macy’s customer service and save receipts.

- Layaway & registries: Macy’s will typically provide instructions for handling registries or layaway accounts; start those conversations early.

- Warranties and repairs: Some warranty services may be honored through corporate service centers or transferred to other stores; document purchases and warranties.

- Bankruptcy risk: While Macy’s closures do not necessarily indicate bankruptcy, in any retail downsize, stay alert to official notices if you’re owed refunds or credits.

If you’re unsure about a legal protection or question about your purchases, contact Macy’s customer service via official channels and save written confirmations.

Conclusion: The End of an Era — or a New Beginning?

Change is never painless, especially when it touches places that have been part of people’s lives for generations. Macy’s 2025–2026 closures mark the end of many familiar shopping rituals, but they also represent a deliberate pivot to a leaner, more digitally-driven future.

For shoppers, the practical impact is straightforward: fewer massive local stores, more emphasis on online shopping and smaller local formats, and a wave of liquidation sales and opportunities. For employees, the transition can be difficult but not uniformly terminal — Macy’s is attempting to redeploy and retrain where possible. For communities, anchor vacancies mean new possibilities — redevelopment, mixed-use projects, or new retail concepts.

Ultimately, Macy’s ability to remain relevant will depend on how well it marries the convenience and scalability of digital commerce with the human elements of service, curation, and trust that department stores historically provided. The Macy’s of 2030 may look very different — but it could still be Macy’s, in spirit if not in square footage.

Frequently Asked Questions

Q1: Are Macy’s gift cards still valid after a store closes?

Gift cards are generally still valid through Macy’s corporate systems (online and at other stores). It’s smart to use them sooner rather than later and keep digital copies or receipts in case you need customer-service help.

Q2: Will Macy’s honor returns at other locations after my local store closes?

Yes — generally Macy’s will accept returns at other Macy’s locations and online, but policies can vary during liquidation periods. Retain receipts and check the current return policy on macys.com or contact customer service for confirmation.

Q3: How can I find out if my Macy’s is closing?

Macy’s typically announces closures via press releases, local news, and signage at the store. Also check macys.com or call the store directly. (Note: I can’t browse the web right now to verify live lists, so it’s best to check official Macy’s channels.)

Q4: Will Macy’s stores be converted into fulfillment centers?

Some closed locations have been repurposed as local fulfillment or micro-fulfillment hubs. Macy’s is using real estate creatively to support e-commerce, though not every closed store will become a fulfillment center.

Q5: What should I do if I work at a Macy’s that’s closing?

Ask HR about transfer options, severance, and retraining programs. Apply for open roles at nearby Macy’s or corporate fulfillment roles, and check local job resources and unemployment services to bridge the gap.